Table of Contents:

-

Market Moving Headlines

-

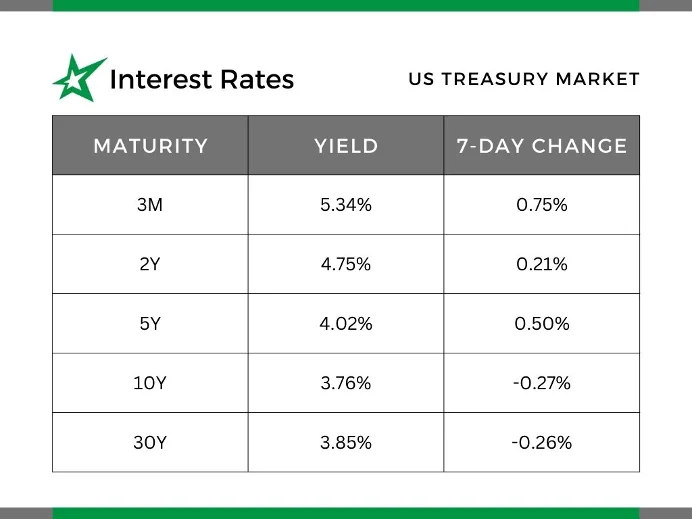

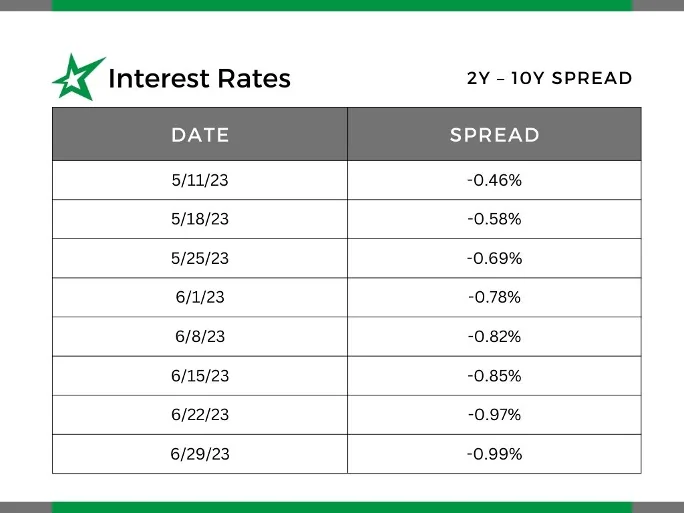

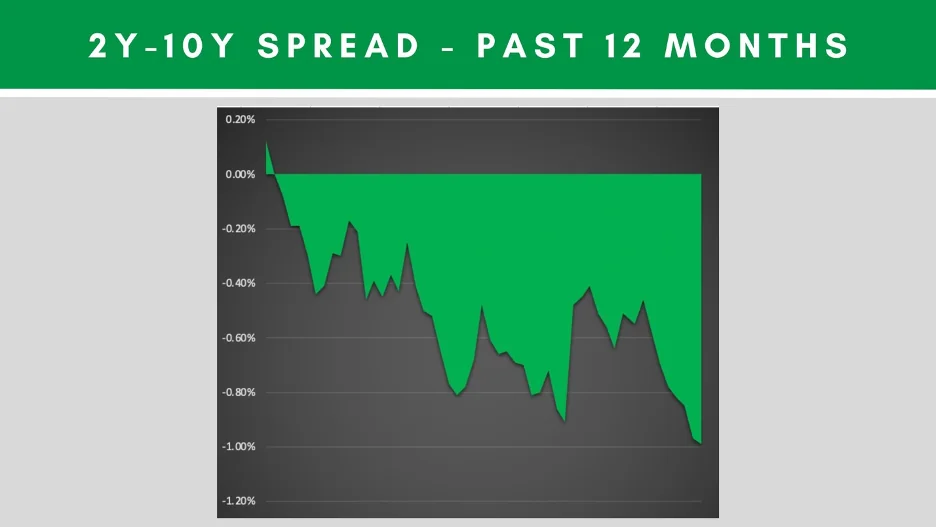

Interest Rates

-

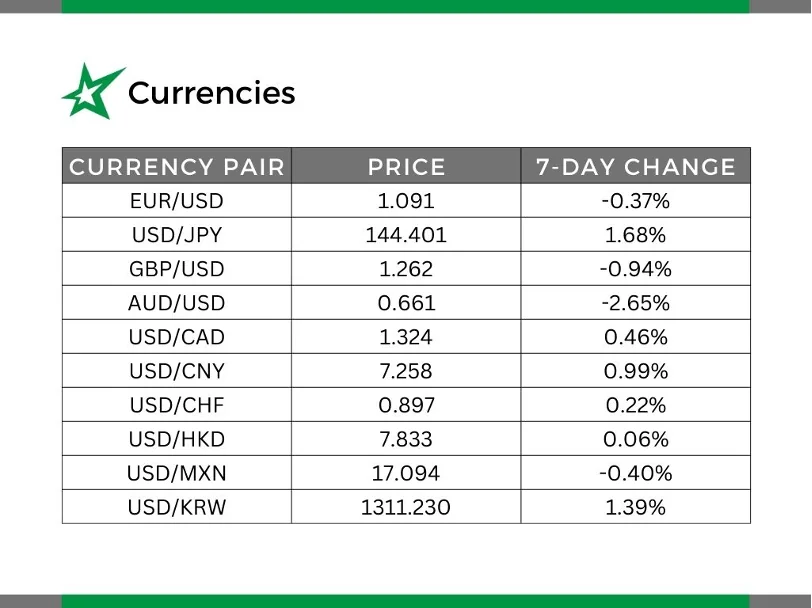

Currencies

-

Commodities

-

Concept of the Week: Risk versus Speculation

-

Quote of the Week

Market Update:

-

US new home sales are the highest in over a year.

-

US mortgage applications rose for a third week.

-

Canadian inflation slows to a near 2-year low.

-

Durable goods orders beat forecasts for the third month.

-

WTI crude slips below $69.

-

French unemployment levels rise for the second month.

-

ECB President Lagarde states that inflation in the Euro will remain high for too long.

-

Fed Chair Powell reiterates the need for further rate hikes.

-

South African Rand fall to a near 3-week low.

-

Sugar falls further to a near 3-month low.

-

Italian inflation falls to a 14-month low.

Interest Rates

Currencies

Commodities

Concept of the Week: Hedge Accounting – Portfolio Layer Method

Fair value hedge accounting allows financial institutions to hedge the value of balance sheet assets and reduce earnings volatility in kind. This is called the portfolio layer method.

The portfolio layer name comes from the idea that, within a given pool of prepayable fixed-rate assets, the portion being hedged is presumed to be the ‘portfolio layer’ affected last by prepayments such as early paydowns, defaults and refinancings.

The portfolio layer method offers institutions a path for navigating onerous hedge accounting requirements, creating more effective hedge relationships that better align with the risk management objectives of the institution.

The portfolio layer method can be distilled into three key pieces:

-

Hedging a partial term

-

Targeting a principal amount, and

-

Designating the benchmark interest rate.

Each of these pieces is necessary to achieve an effective fair value hedge.

For financial institutions with meaningful exposure to fixed-rate assets, the portfolio layer method achieves three key objectives:

-

It protects the value of their capital.

-

It mitigates duration risk in assets.

-

It reduces income statement volatility caused by mark-to-market gains and losses from the periodic revaluation of derivatives.

The portfolio layer method is not for the faint of heart. This accounting guidance is dense and complicated. HedgeStar can be your guide to help navigate its complexities so you can realize the benefit from this groundbreaking standard.

Quote of the Week

“The only limit to our realization of tomorrow will be our doubts of today.” – Franklin D. Roosevelt

Want this article in PDF form? Check it out!

Author: John Trefethen, Director and Co-Founder

Mobile: 612-868-6013

Office: 952-746-6040

Email: jtrefethen@hedgestar.com

HedgeStar Media Contact:

Megan Roth, Marketing Manager

Office: 952-746-6056

Email: mroth@hedgestar.com

Check out our services: