PRIMER:

Highway 40, the old Route 66, stretches more than 2,550 miles across the US, from Barstow, California on the west coast to Wilmington, North Carolina on the east. Much of I-40’s western half parallels that of the new Route 66, the “Main Street of America.” Though not quite as famous, the importance of I-40 lies not in its length, but where it intersects the center of the Texas panhandle, the backdrop for our case study.

ABC Depository (“ABC” or the “Depository”) is a technology-driven, community depository headquartered in a growing city in the Southwest. It has four locations and offers traditional depository services from consumer and commercial loans to checking accounts, money markets and CDs. ABC has a strong value proposition, delivering ease and efficiency by scaling services with technology. This means faster money transfers, quicker loans, less bureaucracy, and ultimately, fewer headaches for its customers.

It’s a proposition befitting the city where the depository is located, one of the fastest growing mid-market economies in the country. In a city with a population just over 200,000, it offers low unemployment (2.6%) and diverse industry across agriculture, meatpacking, petroleum, and transportation. For these and many other reasons, this city is no stranger to financial institutions vying for borrower and depositor business. Large national banks as well as small- and mid-sized regional banks all compete for credit. Now, drive an hour east and the story is much different…

This part of the Southwest epitomizes small town America. With a hair over 650 people, it is not the vision of burgeoning commerce that its neighbor down the road appears to be. It looks like a stop on a road trip – a place to rest a moment before moving on. The red bricks adorning Main Street invite passersby into its small handful of shops and restaurants. At the corner of 1st and Main is an ABC Depository office.

ABC Depository is the anchor of this town. It offers vital access to capital for the town’s residents. Capital that is needed to keep the local economy moving and functioning. The critical role that ABC Depository has in the economies of these small towns cannot be overstated, which is why risk management has become an even greater topic of conversation in recent months. Today, as large institutions collapse due to financial mismanagement, few feel the sting of these closures more than the people that need those services the most – the customers.

This case study highlights ABC Depository’s journey to sound interest rate risk management and how they addressed macro balance sheet risk head-on without jeopardizing a modest capital structure.

About the Depository

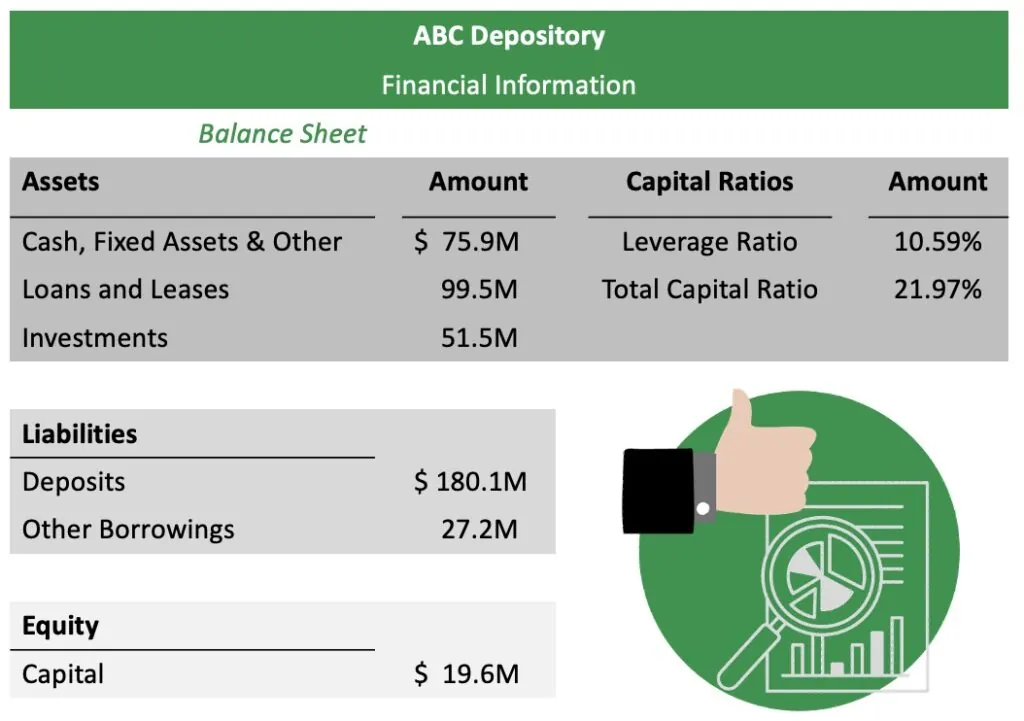

ABC Depository has a total of $226.9M in assets. Of the $226.9M in assets, $99.5M are Loans and Leases, $51.5M are investments, and the remaining $75.9M are cash, cash equivalents, fixed and other assets. The $99.5M loans are mostly commercial/industrial loans, mortgage loans and construction loans. The $51.5M investments are mostly US Treasuries, agency-issued obligations, and agency-issued residential mortgage-backed securities.

On the funding side of the balance sheet, ABC Depository has $180.1M of deposits, $27.2M other borrowings and $19.6M capital. The $180.1M of deposits comprises $23.8M and $156.3M of transaction (e.g., checking) and non-transaction (e.g., savings, money markets, certificates of deposit) accounts, respectively.

ABC Depository is the picture of health when it comes to key financial ratios. Its leverage ratio, or tier 1 capital as a percentage of total average assets, is a respectable 10.59%. Institutions with leverage ratios greater than 9% are deemed to have satisfied the regulatory agencies’ general capital rule [1]. ABC Depository has a total capital ratio of 21.97%, which eclipses the 8% minimum capital requirement under the capital adequacy standards (12 CFR Part 3.10). Turn the page to net interest margin, and the picture gets murkier.

PROBLEM:

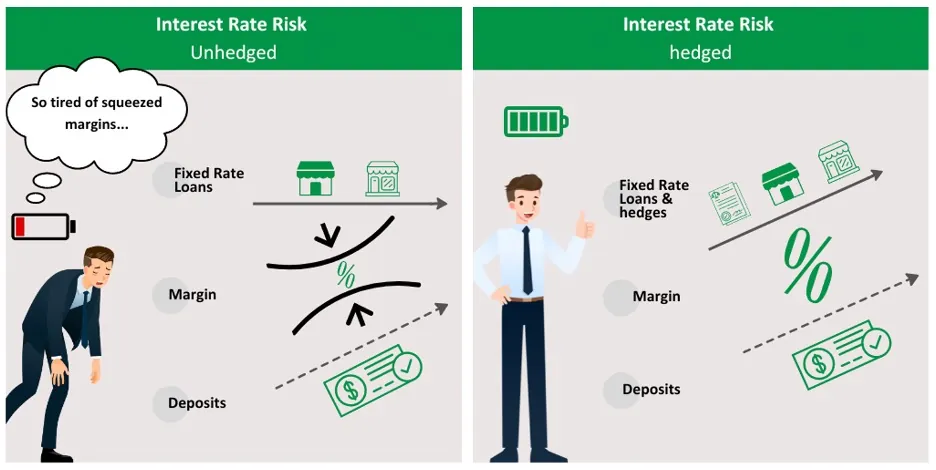

Institutions have been managing interest rate risk (“IRR”) for ages. For most, IRR is simply this: the potential for a meaningful decline in the economic value of equity and/or a significant reduction in net interest margin (“NIM”). Managing IRR is a tightrope walk for institutions trying to find the optimal balance between their lending and funding activities, and all while trying to satisfy the demands of borrowers and depositors.

For all of its capital fortitude, ABC Depository’s net interest income is $1.2M. Add in non-interest income and expense, and that number falls to $0.4M. Interest rate risk? Yes. How did it happen? That’s another story…

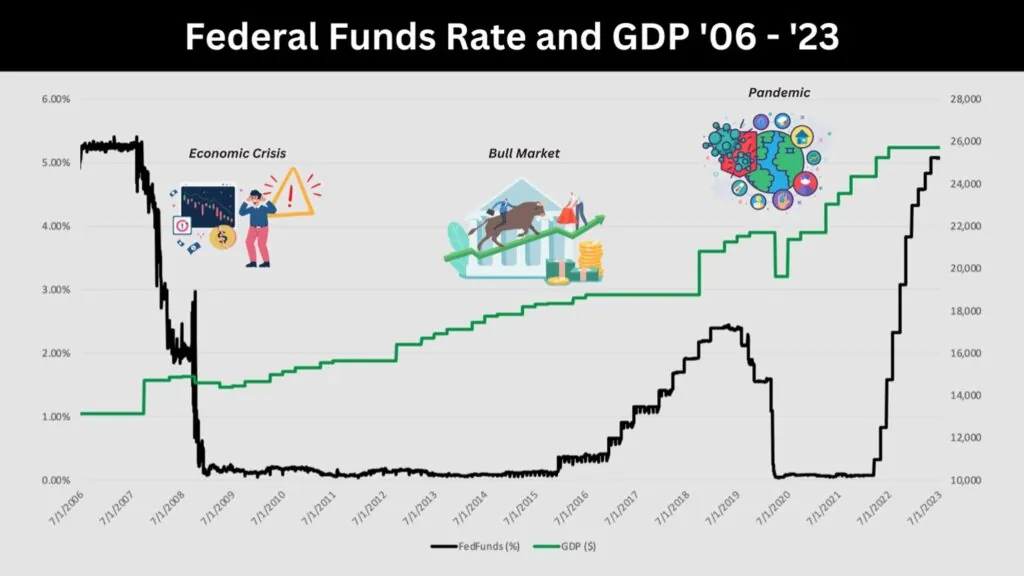

The issue facing so many institutions in the current interest rate environment was created years ago. The economic crisis of 2008/2009 ushered in historically low interest rates that would remain fixed at levels not seen since the great depression. In 2016, encouraged by a strengthening labor market and improvements in the economy, the Federal Reserve (the “Fed”) would begin a measured, yet concerted effort to raise rates. Optimism then shifted quickly in 2019 on the heels of a decline in economic activity with indicators pointing to slower household spending, reduced business investment, and higher unemployment. The latter part of 2019 saw the Fed’s sentiments change from “hold steady” to “cut rates down,” reversing nearly all of the increases levied in the year prior.

The bull market from 2010 to 2019 was seen as the longest in history. All of the capital amassed during that time, coupled with historically low borrowing costs, would give rise to an enormous lending and spending spree. Existing borrowers refinanced and new borrowers availed themselves of cheap financing. Credit was free flowing to all corners of all industries. Deposits grew with the loans and liquidity was plentiful. The powder keg was filling up.

And then came COVID-19. Price volatility; stimulus; negative oil prices; supply chain disruption; market dislocation – the pandemic will be forever etched in the annals of time as a 3-year period characterized by dysfunction and unrest. As the sun sets on COVID, the markets and regulators have turned their attention back to inflation. And how do you combat inflation? You raise interest rates…

The bull market saddled institutions with low coupon mortgages and low yielding investments. Meanwhile, rate sensitive deposits such as money markets and shorter duration certificates would increase the cost of funds. Net interest margin begins to squeeze. Match lit.

Throw in some skittish depositors with cash flow concerns, and the destruction ensues. First Silicon Valley Bank, then First Republic Bank, and the list of troubled institutions goes on and on.

THE SOLUTION:

The same was true for ABC Depository. “I’m competing for business loans and my customers only want fixed rates,” remarks the incredulous President of ABC Depository. Low fixed-rate rate loans notwithstanding, ABC Depository was acutely aware of its margin challenges, and it decided to take action.

ABC Depository set out to reduce its IRR exposure head on. First, the ABC evaluated its options. Would it execute an over the counter (“OTC”) hedge, such as an interest rate swap? Or would it leverage the exchange and use futures? ABC Depository was leery of the OTC path for a couple reasons: a) the credit assessment and ISDA contracting process with the wall street dealers can be notoriously fussy and time consuming, and b) the rate that wall street charges smaller institutions for derivatives is closer to highway robbery, than it is to honest “fee-for-service” market making. Dealers also require collateral as consideration for counterparty credit risk, which is a negotiated portion of the ISDA agreement called the Credit Support Annex. Dealers’ collateral requirements can be downright Machiavellian if the credit worthiness of the user is anything less than flawless.

Treasury futures were another option for the Depository. These are highly-liquid, exchange-traded derivatives whose pricing is tethered to underlying US Government Notes and Bonds. Treasury futures, like any exchange-traded product, have daily variation margin requirements that can fluctuate depending on the significance of the change in price of the derivative(s). However, US treasuries are not aligned with ABC funding sources such as overnight deposits and Federal Home Loan Bank advances. An institution’s cost of funds is more compatible with overnight interest rate indices such as the effective federal funds rate or the secured overnight financing rate (“SOFR”). Concerned with the basis risk posed by Treasury Futures, ABC Depository’s search for a hedging instrument continued.

ABC Depository finally settled on the Eris Swap Futures contract. The Eris contracts represent the best of both worlds – the ease and transparency of the exchange coupled with the flexibility and access to SOFR akin to OTC contracts. Eris contracts are less than half the margin of equivalent OTC interest rate swaps and they typically trade at more than a basis point tighter than interest rate swaps cleared through a Central Clearing House. “It was the simplest option and gave us optimum flexibility to rebalance our hedging portfolio if needed,” said the ABC Depository President. Hedging instrument chosen, now on to strategy.

Institutions with a macro-balance sheet risk view are often faced with a choice. Do I reduce duration risk by hedging fixed-rate assets or do I extend duration by hedging floating rate liabilities? The answer to this question is usually a function of an institution’s risk appetite and its customer approach. For ABC Depository, its growing fixed-rate business loans were the primary source of interest rate risk, and loan volume was only expected to increase over time. Thus, the focus was solidified.

The conceptual aspects to hedging are one thing, the practicality of implementing it is something quite different. ABC Depository was required to create a closed pool of loans. These loans needed to be relatively consistent in terms of geography, seasonality, credit risk, duration, and coupon. Homogeneity is important so that the cash flow behavior of the pool is easier to assess and predict despite any adverse market conditions. And not to be outdone, ABC Depository was determined to achieve preferential accounting treatment under the Financial Accounting Standards Board ASC topic 815, also known as “hedge accounting.”

New to hedging, ABC Depository needed assistance. HedgeStar evaluated the Depository’s proposed pool and made adjustments to ensure that weighted-average life of the pool was expected to be as long or greater than the life of the hedging instruments. ABC Depository performed principal analysis, looking at payoff probabilities, borrower covenants and prepayment stipulations. Ultimately, ABC Depository and HedgeStar identified two closed-pools to be hedged – one for family residential and another for nonfarm, nonresidential business loans. Portfolios pragmatically constructed. Time to hedge.

Execution of the Eris Swap futures was seamless. Working through its broker – RJ O’Brien – ABC Depository chose to hedge two, three, four, five and seven-year terms on the contracts, addressing the front end of an upward sloping yield curve at the time. Total notional amounts on the hedges were $17.6M out of approximately $42.9M across all hedged assets. Average hedge ratios across the family residential and nonfarm, business loan pools were roughly 32% and 90%, respectively.

With hedges in place, the fun part comes next – effectiveness testing! ASC topic 815 requires institutions to assess hedge effectiveness on a quarterly basis at a minimum. HedgeStar chose for ABC Depository a scenario analysis using the “DV01,” or dollar value change given a 1 basis point shift in interest rates, which is a common metric employed for interest rate risk assessment. The DV01s of the hedges divided by the DV01s of the hedged items give us our effectiveness ratios. An effectiveness ratio greater than or equal to 80%, and less than or equal to 125%, is deemed to be effective in the eyes of FASB and the regulatory authorities. ABC Depository achieved effectiveness ratios ranging from 92% to 96% on its positions. Thumbs up; onward to accounting and financial reporting.

Hedging can be a fussy process. From hedge ratio monitoring to ongoing counterparty credit risk assessment and effectiveness testing, there are some that feel the end does not justify the means. Indeed, hedge accounting is a labor of love, but the benefit lies in financial statement presentation. In the case of ABC Depository, a sharp yield curve inversion created losses on the value of its assets, but produced a meaningful, offsetting gain on its hedges to the tune of $1.2M. Since the Depository was hedging fixed-rate loans, all of the hedging gains are attributable to interest income and can be recorded as such. Thus, the impact of the hedges was a boon to net interest margin, which was a welcome update to ABC Depository’s call report.

Conclusion:

Borrowers and depositors will always maximize their own utility – the former seeks lower rates for longer periods and the latter seeks higher rates. In low-rate environments, balance sheets are usually net long and liability sensitive. In high-rate environments, balance sheets are usually net short and asset sensitive. Hedging allows financial institutions to synthetically augment their IRR profile without affecting the disposition of borrowers and depositors.

The industry saying is that “every balance sheet is different and every institution’s risk culture is unique.” While this may be true, the reality is that financial institutions are all vying for the same or similar business. Thus, hedging is a competitive advantage that allows institutions to price for growth while being largely indifferent to market swings. With this in mind, Eris swap futures provide unfettered access for institutions, especially smaller ones, to benefit from interest rate risk management without feeling beholden to the whims of global investment banks. Eris swap futures are not for wall street, they exist for main street.

[1] Office of the Comptroller of the Currency / Federal Deposit Insurance Corporation / Board of Governors of the Federal Reserve System. Community Bank Leverage Ratio Framework – NR-IA-2019-125c.

Want to learn more about HedgeStar’s services? Let’s chat!

Media Contact:

Megan Roth, Marketing Manager

Office: 952-746-6056

Email: mroth@hedgestar.com

Check out our services: