Table of Contents:

-

Market Moving Headlines

-

Interest Rates

-

Currencies

-

Commodities

-

Concept of the Week: Risk versus Speculation

-

Quote of the Week

Market Moving Headlines

-

The Fed Raises Interest Rates to a 22-year high.

-

US new home sales fell more than forecast.

-

US house prices fell for the third month.

-

Canadian manufacturing sales shrink in June 2023.

-

Hong Kong imports drop 12.3% year-over-year in June 2023.

-

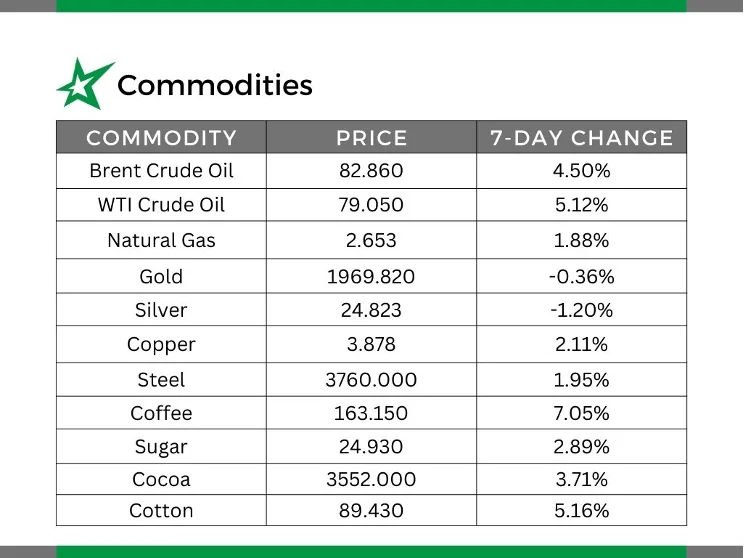

Coffee rebounds from a six-month low.

-

Copper futures surge on Chinese stimulus pledge.

-

Wheat futures holds near a five-month high.

-

German business confidence at an eight-month low.

-

Gasoline futures rose to a one-year high.

-

Oil prices hover at a 3-month high.

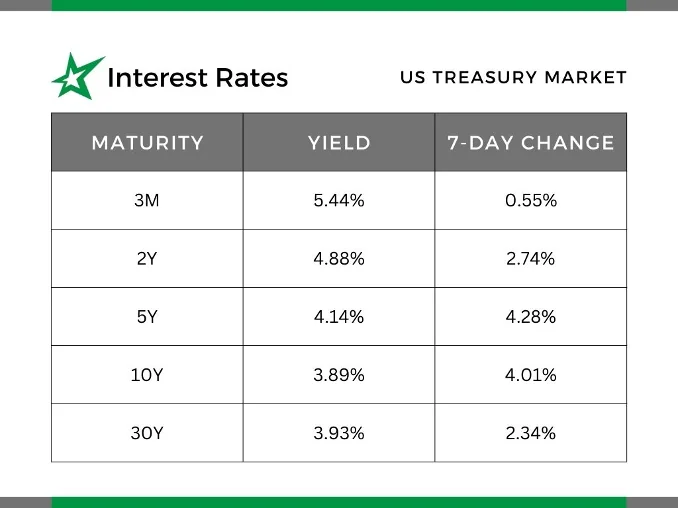

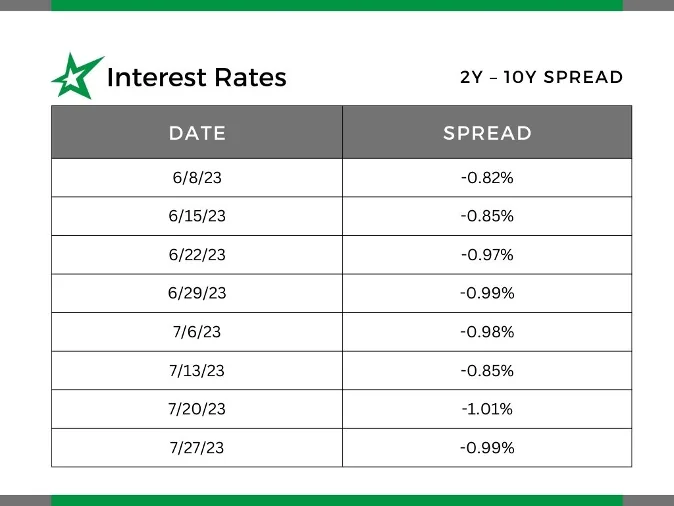

Interest Rates

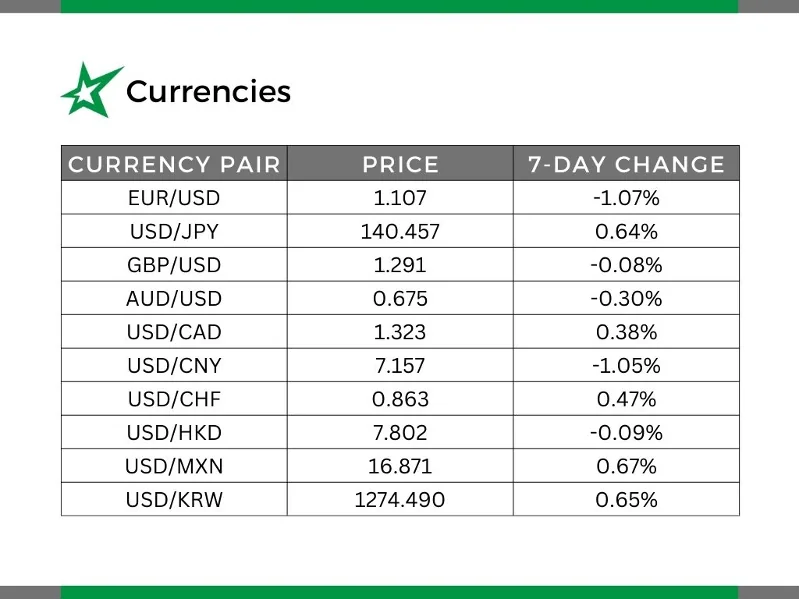

Currencies

Commodities

Concept of the Week: Net Interest Income

Net interest income simulation models measure the effect that interest changes will have on net interest income. If calibrated properly, this model will capture the following four types of interest rate risk. The four types include:

-

Repricing

-

Basis

-

Yield Curve

-

Option

Net interest income is simply interest income minus interest expense. In the model, a baseline of the balance sheet is established. The baseline is the balance sheet’s performance in a static interest rate environment. The balance sheet is then subjected to different interest rate scenarios (stress tests and shock scenarios) and compared to the baseline. A higher variance in these results reflects higher interest rate risk in the balance sheet.

The effectiveness of this model is limited to the quality of the input assumptions.

Quote of the Week

“You are the result of your choices, not your circumstances.” – Seneca

Want this article in PDF form? Check it out!

Author: John Trefethen, Director and Co-Founder

Mobile: 612-868-6013

Office: 952-746-6040

Email: jtrefethen@hedgestar.com

HedgeStar Media Contact:

Megan Roth, Marketing Manager

Office: 952-746-6056

Email: mroth@hedgestar.com

Check out our services: