As the NCUA considers easing the derivative application rules, there have been some critics to this proposal. The proposed rule change would provide the following:

-

Eliminate the application process for federal credit unions with at least $500 million in assets that have CAMELS rating of 1 or 2.

-

Eliminate the regulatory limits on the amount of derivatives a federal credit union may enter into.

-

Eliminate the limitation of a forward-start date beyond 90 days.

-

Eliminate the specification of allowable derivative instruments as long as they meet the following criteria:

– Are U.S. dollar denominated

– Are based off domestic interest rates or dollar denominated LIBOR

– Have a maturity less than or equal to 15 years

– Are not used to create structured liability offerings

Critics have portrayed the proposed rule change as a tactic that will allow credit unions to invest in derivatives and expand their exposure to derivatives, equating this to taking on unnecessary risk. What seems to be lost is that not hedging interest rate risk introduces far more risk compared to hedging with derivatives.

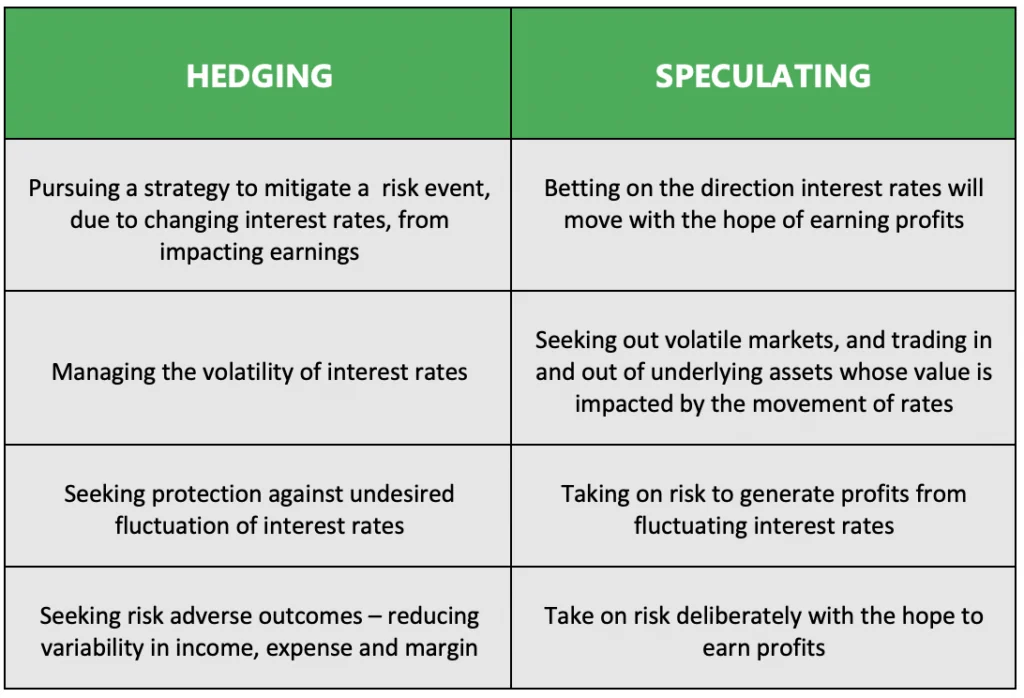

There are many types of derivatives that are used for taking on risk – that speculate on the movement of interest rates. The NCUA expressly prohibits using derivatives for speculation – a stance unchanged by the proposed rule. What the NCUA currently allows, and what is allowed in the proposed rule, is for hedging activity. When hedging, credit unions are not guessing on the direction of interest rates. Instead, they are mitigating the risk of capital value or cash flow variability should interest rates move in a direction that negatively impacts the credit union. Not hedging a risk can be considered speculation. If a credit union decides not to hedge an exposure to a move in interest rates, that institution is implicitly speculating that interest rates will not move in a direction that will adversely impact their institution.

Speculators take positions in assets with the expectation that the asset will change in value in a way that will be profitable to the speculator. The deliberate, risk seeking appetite of speculators plays a critical role in providing liquidity in the market for all participants, including hedgers. However, it is not a role credit unions should consider taking on.

If you are considering using interest rate derivatives, consider the following factors to help determine if the activity is hedging or speculating:

When used prudently, derivatives are an invaluable tool for managing risk. The concepts contained in the proposed derivative rule change, are a demonstration of prudent use of derivatives. For more information on hedging interest rate risk, feel free to schedule a call with an expert at HedgeStar.

Contact the Author:

John Trefethen, Director and Co-Founder

Office: 952-746-6040

Email: jtrefethen@hedgestar.com

Media Contact:

Megan Roth, Marketing Manager

Office: 952-746-6056

Email: mroth@hedgestar.com

Check out our services: