Table of Contents:

-

Market Moving Headlines

-

Interest Rates

-

Currencies

-

Commodities

-

Concept of the Week: Risk versus Speculation

-

Quote of the Week

Market Moving Headlines

-

Fed prepared to raise rates further to combat inflation.

-

US job openings slump to a 28-month low.

-

US house prices decline for the fourth month.

-

US mortgage rates rise to a 22-year high.

-

US private employment rises less than expected.

-

Gold hovers around 1-month highs.

-

Euro strengthens to over a 2-week high.

-

Chile jobless rate up to 8.8%.

-

US goods trade deficit widens in July.

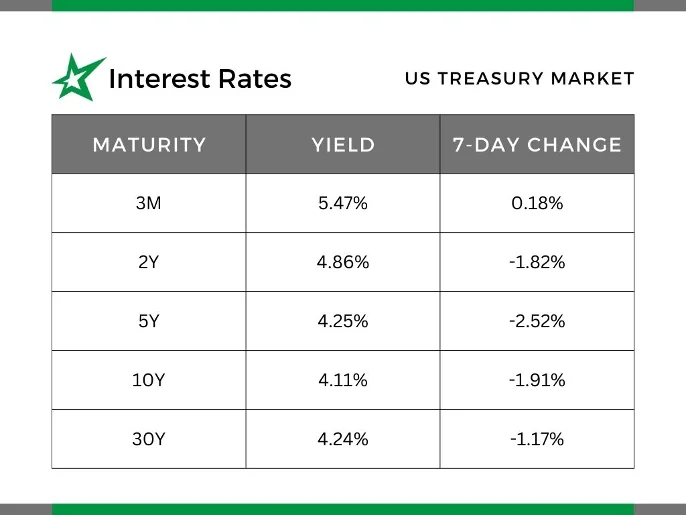

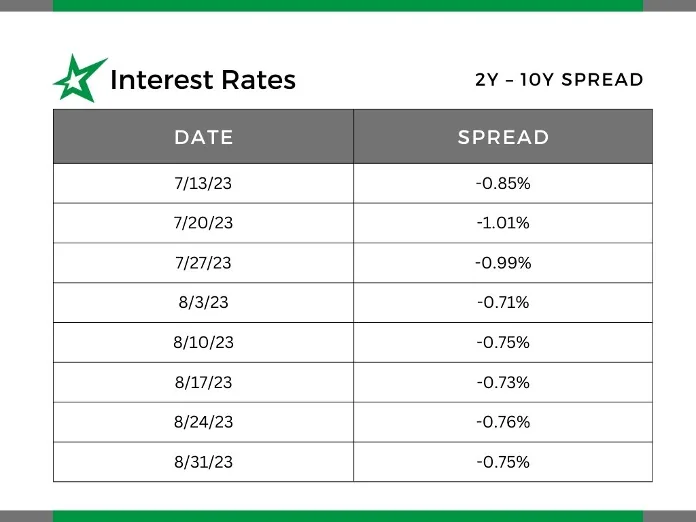

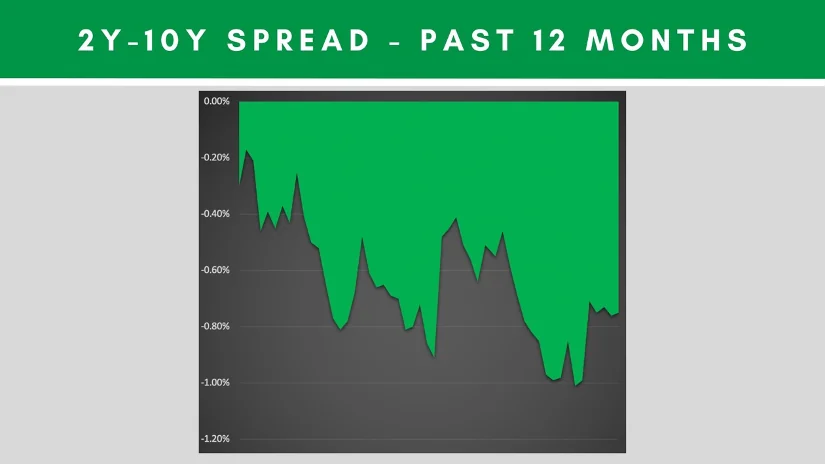

Interest Rates

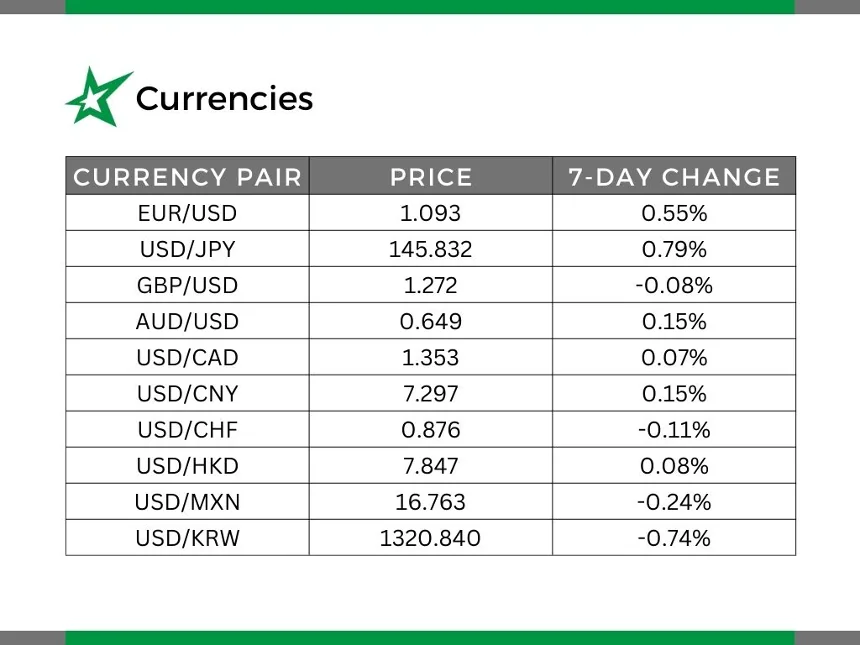

Currencies

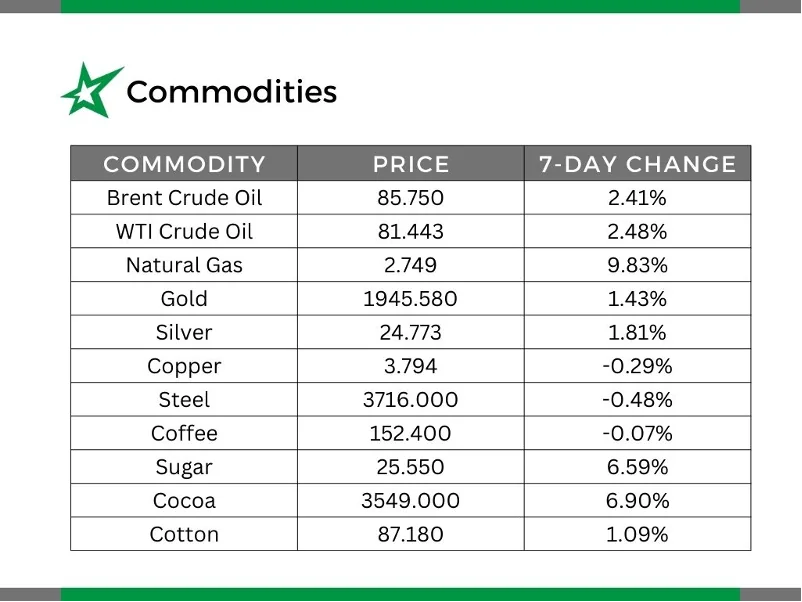

Commodities

Concept of the Week: the impact of having to restate financial statements

An error in reporting hedge accounting results can lead to the need to restate a company’s financial statements. Restating financial statements involves correcting those errors and presenting accurate and reliable financial information to investors, regulators, and the public. Below is generally what happens when a company needs to restate its financial statements.

-

Identification of Error(s): The company’s internal audit, external auditors, or management discover the error(s).

-

Analysis and Correction: The company should thoroughly investigate the errors to understand their nature, cause, and impact on the financial statements.

-

Restating Financial Statements: After the corrections are made, the company will prepare revised financial statements that accurately reflect the corrected financial information.

-

Disclosure: The company is required to disclose the restatement and the reasons for it. This is usually provided through a press release or a filing with a regulatory body.

-

Impact on Stakeholders: Restating financial statements can have various implications for stakeholders. Investors might lose confidence in the company’s financial reporting which could lead to a decline in the company’s stock price. Creditors might reassess their lending terms, and regulators may scrutinize the company more closely.

-

Legal and Regulatory Consequences: Depending on the severity of the errors, there could be legal consequences including regulatory actions and/or civil litigation.

-

Rebuilding Trust: After a restatement, the company will need to rebuild trust with its stakeholders. This may involve improving internal controls, enhancing transparency in financial reporting, and demonstrating a commitment to accuracy and integrity.

Restating financial statements can have significant repercussions on a company’s reputation, financial health, and legal standing. When reporting results from specialized activities such as hedge accounting, companies should consider enlisting external experts to ensure accuracy of reporting.

Quote of the Week

“A failure to plan is a plan to fail.” – Benjamin Franklin

Want this article in PDF form? Check it out!

Author: John Trefethen, Director and Co-Founder

Mobile: 612-868-6013

Office: 952-746-6040

Email: jtrefethen@hedgestar.com

HedgeStar Media Contact:

Megan Roth, Marketing Manager

Office: 952-746-6056

Email: mroth@hedgestar.com

Check out our services: