Table of Contents:

-

Market Moving Headlines

-

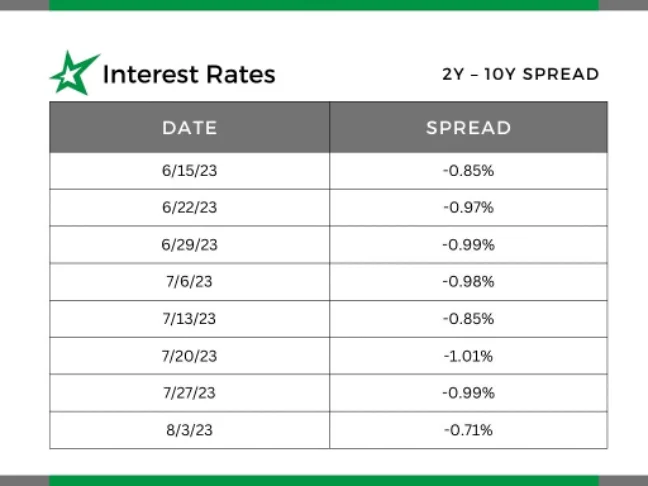

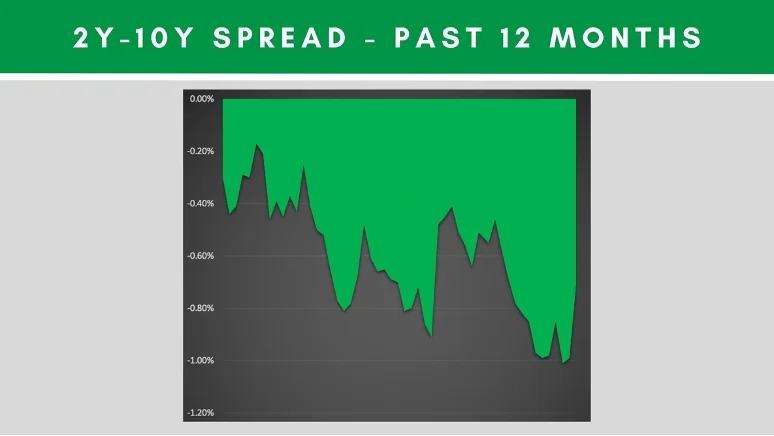

Interest Rates

-

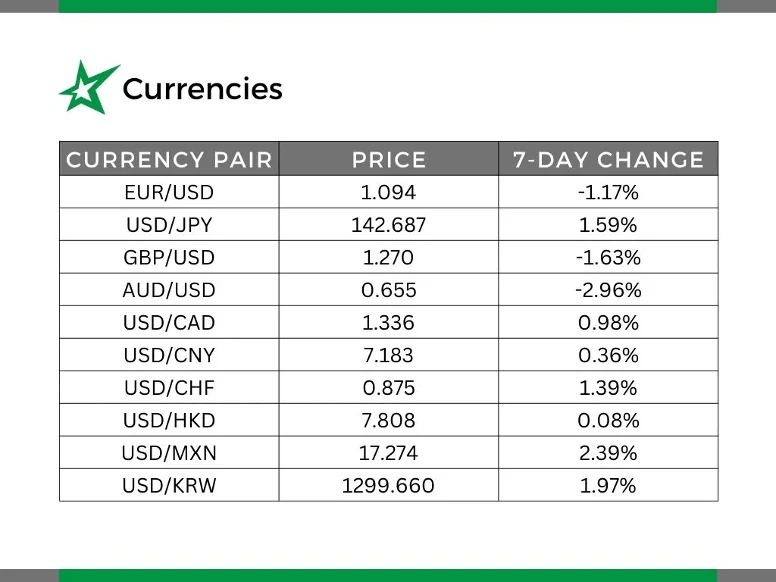

Currencies

-

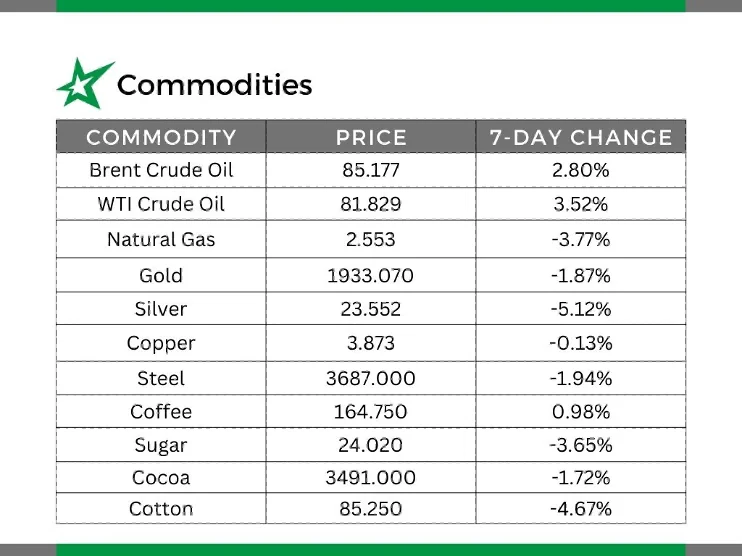

Commodities

-

Concept of the Week: Risk versus Speculation

-

Quote of the Week

Market Moving Headlines

-

Natural gas rebounds from a 7-week low.

-

Germany electricity spot prices surge by 117.11%.

-

Colombian exports plunge for 7th straight month.

-

Oil rises after Saudia Arabia and Russia cut production.

-

The ISM Services PMI fell in July after reaching a 4-month high in June.

-

The yield on the US 10-year Treasury note continued to rise in August to 4.19%.

-

US initial jobless claims edge higher than expected.

-

US labor costs rise less than expected.

-

The Bank of England raised its policy interest rate by 25 basis points to 5.25%.

-

Wheat declines to a 3-week low.

-

Gasoline retreats from a 1-year high.

Interest Rates

Currencies

Commodities

Concept of the Week: Explaining Hedging to Leadership

When implementing a hedging program, it is critical to educate and inform your leadership on what hedging is and is not. Some point to emphasize with leadership include:

-

Hedging is for preventing an existing risk from materially impacting earnings.

-

Hedging is not speculation.

-

Hedging is an exercise to manage volatility in the market.

-

Hedging offers protection against undesired market fluctuations.

-

Hedging is taken on by institutions that are risk adverse.

-

Not hedging is speculating.

Responsible and forward-thinking organizations will develop and implement a hedging program that aligns with their financial objectives and risk tolerance.

Quote of the Week

“The best way to predict the future is to have a strategy to protect against it.” – Paul Tudor Jones

Want this article in PDF form? Check it out!

Author: John Trefethen, Director and Co-Founder

Mobile: 612-868-6013

Office: 952-746-6040

Email: jtrefethen@hedgestar.com

HedgeStar Media Contact:

Megan Roth, Marketing Manager

Office: 952-746-6056

Email: mroth@hedgestar.com

Check out our services: