For most people, the word “options” means choices. Do I get plain black coffee? Or do I test my pancreas with a large, extra vanilla, sweet cream, iced latte (shaken, not stirred)?

In the capital markets, an option is a tradeable financial instrument that gives the holder the right, but not the obligation, to buy or sell an underlying asset at a pre-determined price or rate. Examples of options can be found almost anywhere: the deposit you put down to reserve that shiny new boat; car leases that allow for bargain purchase at expiry; or debt issuance with a clause that gives the issuer the right to buy it back before maturity.

Options have existed for a long time. One of the first examples originates in ancient Greece. Aristotle detailed a story about how fellow philosopher, Thales of Miletus (“Thales”), benefited from an option-type agreement around 6th century b.c. The story alleges that Thales had forecast the next olive harvest would be strong. As a person of modest means, Thales used what little he had to place a deposit on local olive presses. Thales purchased the rights to the presses at a relatively low rate as nobody knew for certain whether the harvest would be good or bad. Lucky for Thales the harvest was abundant, and so demand for the olive presses was high. Thales charged a lofty price for use of his presses and reaped considerable gains[i].

Option values are driven by an underlying security or index. As such, Options are available for trading in most asset classes such as equities, interest rates, currencies, and commodities. They are traded on an exchange as listed derivatives or over-the-counter in a bilateral arrangement with a financial institution or broker/dealer.

scientist looking through microscope at data

Among the many flavors of derivative instruments, Options most closely resemble traditional insurance. Users purchasing options pay a premium upfront in exchange for protection. That protection comes in the form of compensation by the option seller when prices or rates rise above or fall below a given threshold. This threshold is known as a strike. You can think of the strike like the deductible on insurance. When the insured incurs expenses above a certain level, the insurer steps in and covers the cost. It’s a similar concept with options. A financial institution hedging the risk of rising interest rates might purchase an option with a strike rate of 5%. Should the reference index (underlying) exceed 5%, the option buyer would be compensated for the difference between the current market rate and the strike rate, effectively “capping” the option holder’s rate at 5%.

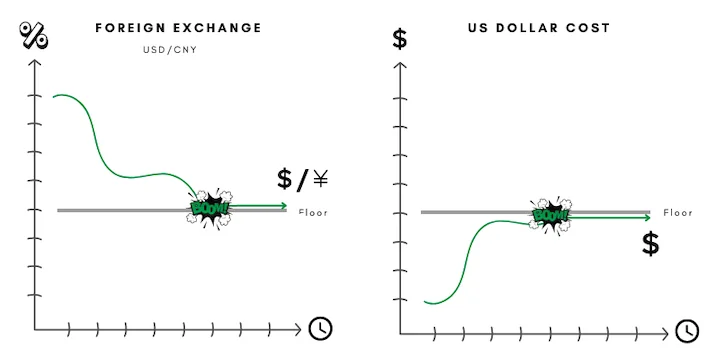

There are many different kinds of options. Among the more basic types are calls (synonymous with a “cap” or “max”) and puts (synonymous with a “floor” or “min”). A call option reduces the risk of rates or prices rising above the strike. A put option reduces the risk of rates or prices falling below the strike.

Options can be purchased or sold. An option buyer is long, meaning the value of the option improves when rates or prices move favorably relative to the strike. An option seller (also known as an option writer) is short, meaning the value of the position is negative and may decrease should rates or prices move unfavorably relative to the strike.

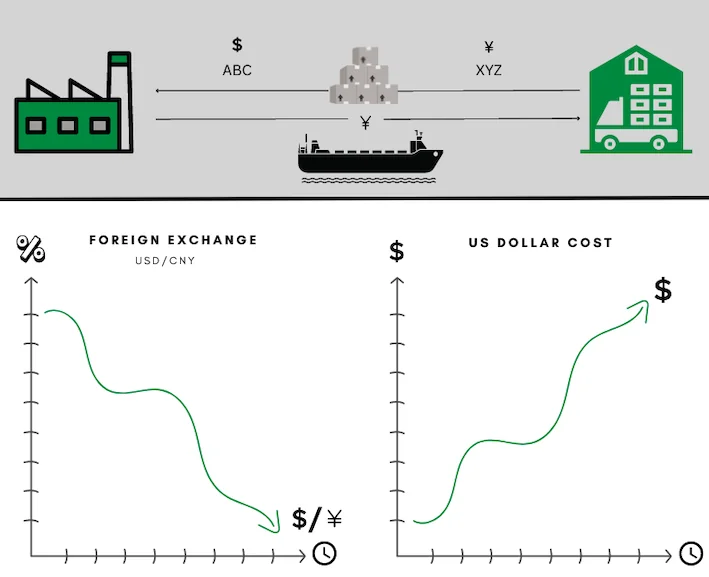

Strategically, options are a helpful tool for users to hedge one-way, directional risk. That is, the risk that markets move quickly and significantly up or down. Unlike forward-type[ii] hedging instruments – such as futures and swaps – that effectively lock-in a rate or price, Options provide users protection from adverse market movements as well as participation in favorable ones. This is illustrated well with currency options:

Consider an example of ABC Manufacturing Company (“ABC CO.”) whose functional currency is US Dollar (“USD”), but it pays monthly for raw material inventory in Chinese Yuan (“CNY”). As raw material purchases represent an expense, or cost of sale, ABC CO. wants the USD/CNY exchange rate to increase. Put another way, ABC CO. wants USD currency to strengthen relative to its Chinese counterpart, meaning every incremental dollar spend is worth more CNY and goes farther toward its monthly purchasing budget.

ABC CO. could enter into a USD put, which would mitigate a decrease in that exchange rate, and thus, a weakening USD relative to CNY. Should the USD/CNY exchange rate fall below the strike, ABC CO. would be compensated for the difference between the spot USD/CNY rate and the strike under the currency put.

However, if USD/CNY remains above the strike, no cash is exchanged, and the option has no intrinsic value[iii]. As you pause a moment to absorb the last sentence, your inner monologue contemplates this: “Exchange rate moves above the strike, but there is no cash exchanged? No intrinsic value?! What the heck is point of this hedge??” You shout incredulously at the screen and slam your delicious, frothy iced latte on the desk. Ok…maybe that was a melodramatic take on your reaction, but let’s back up a moment to explain:

ABC CO. paid a premium up front for protection – protection from a falling USD/CNY exchange rate. If USD/CNY does NOT fall below the strike, then no payment is made by the option seller, and its value is zero. But the critical part here is that ABC CO. can continue to exchange USD for CNY but at the more favorable spot USD/CNY rate. In summary, ABC CO. got the downside protection it desired and enjoyed a better exchange rate than anticipated.

To be fair, options are a more advanced hedging tool than their single settlement, or even multi-settlement, derivative counterparts. From the role that volatility plays in option valuation, to the premium accounting and the uncertainty surrounding future cash flows – all of these things make options inherently more complicated than other derivatives. Having said that, with additional learning and exposure comes greater understanding. It was Benjamin Franklin who once said that “an investment in knowledge pays the best interest.” Alternatively, one could always hire an independent expert to help the uninitiated move quickly up the learning curve! In any case, it’s good to have options…

[i] https://www.businessinsider.com/the-story-of-the-first-ever-options-trade-in-recorded-history-2012-3

[ii] For more examples of forward-type instruments, see our articles entitled What is a Derivative? and What is a Swap?.

[iii] Intrinsic value is the difference between the spot rate or price and the strike rate or price as of any given measurement date.

Meet the Author:

Craig Haymaker, CPA

Managing Director

Craig Haymaker is Managing Director of HedgeStar where he oversees the risk management consulting, software advisory, hedge accounting and valuation practices. He is a subject matter expert in structuring risk management programs as well as financial reporting for debt, equities, derivatives and other financial instruments. Craig has over 15 years of audit, professional accounting, and risk management experience in all asset classes including interest rates, currencies and commodities. Craig has held positions with top companies including Deloitte & Touche LLP (Boston), Liberty Mutual Group (Boston) and U.S. Bank (Minneapolis) with a focus on treasury departments, capital markets and risk functions. Craig is also a board member for the Professional Risk Managers’ International Association (PRMIA).

Education

Craig holds a Bachelor of Business Administration degree in Accounting from Stonehill College, and earned his CPA accreditation in 2010.

HedgeStar Media Contact

Megan Roth, Marketing Manager

Office: 952-746-6056

Email: mroth@hedgestar.com