Table of Contents:

-

Market Moving Headlines

-

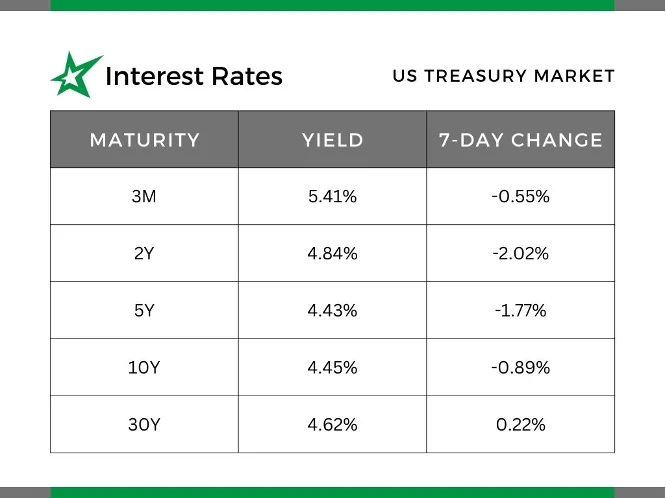

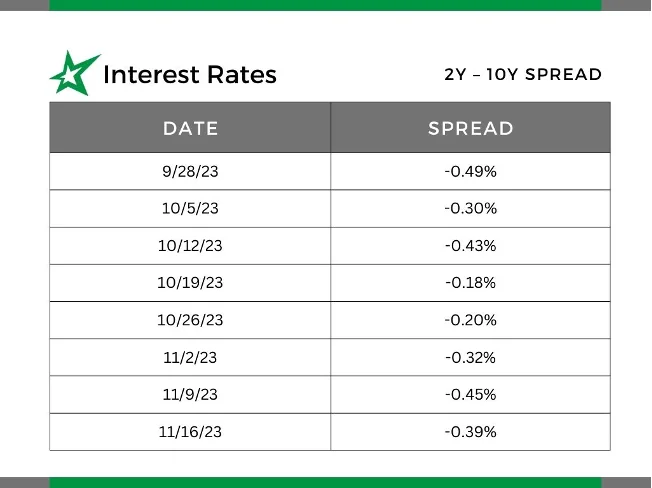

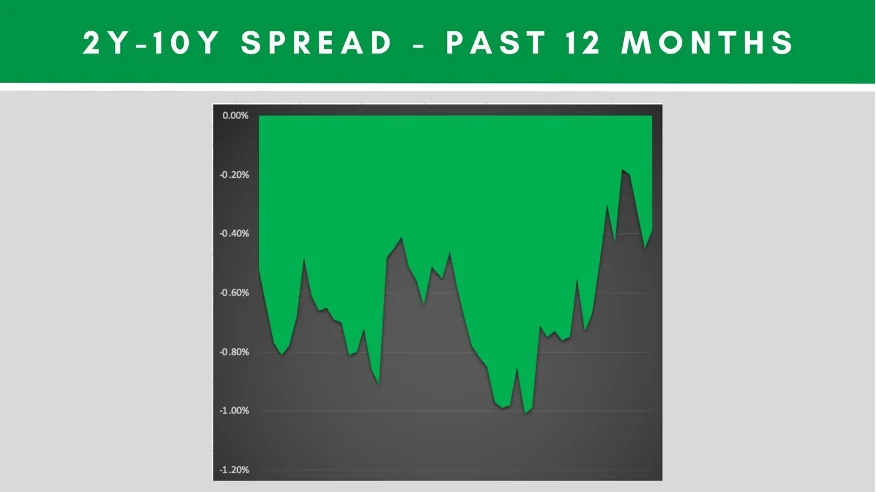

Interest Rates

-

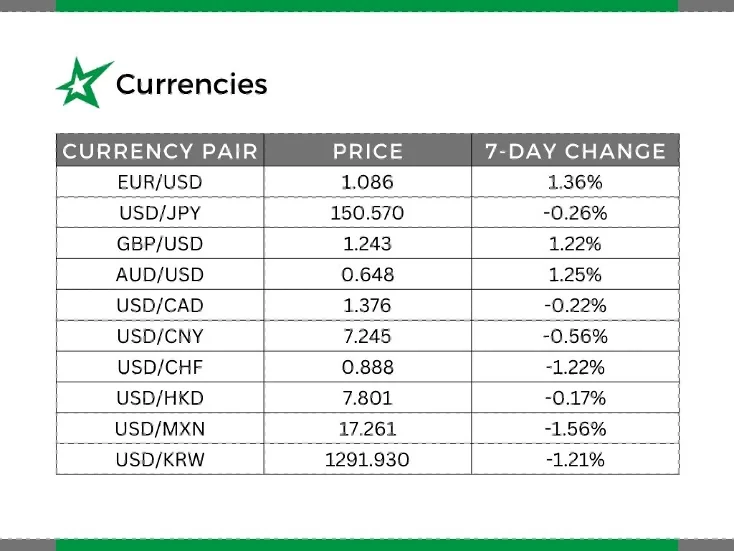

Currencies

-

Commodities

-

Quote of the Week

Market Moving Headlines

-

US PPI falls the most since April 2020.

-

US retail sales fell less than forecasted.

-

US mortgage demand rises to a 5-week high.

-

US 10-year Treasury yield holds at 7-week low.

-

Eurozone GDP forecast for 2023 revised lower.

-

UK inflation rate falls more than expected.

-

WTI crude futures falls due to conflicting perspectives on global oil supply and demand.

-

Canada manufacturing and wholesale sales unexpectedly rise in September.

-

China industrial output rises the most in six months.

-

Japan Q3 GDP shrinks more than expected.

Currencies

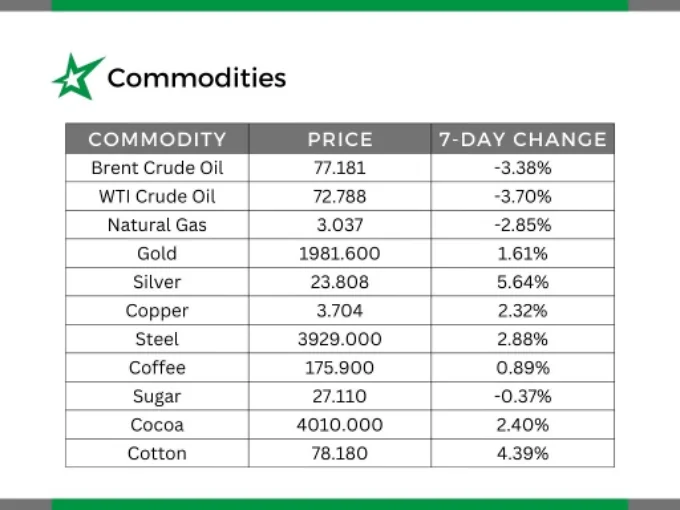

Commodities

Quote of the Week

“The only limit to our realization of tomorrow will be our doubts of today.” – Franklin D. Roosevelt

Want this article in PDF form? Check it out!

Author: John Trefethen, Director and Co-Founder

Mobile: 612-868-6013

Office: 952-746-6040

Email: jtrefethen@hedgestar.com

HedgeStar Media Contact:

Megan Roth, Marketing Manager

Office: 952-746-6056

Email: mroth@hedgestar.com

Check out our services: